Real Estate Market Today: January 2026 (Market Recap & Forecast)

As the New Year begins, many homeowners and buyers—especially those planning a move into a 55+ community—are taking a closer look at where the real estate market has been and where it may be headed next. This January 2026 Realty Report offers a neutral, data-driven recap of 2025 and a forward-looking outlook for 2026 based on forecasts from leading housing analysts and industry organizations.

The goal is clarity, not hype: understanding trends around pricing, inventory, mortgage rates, and what they may mean for active adult buyers and sellers

WATCH FULL VIDEO HERE ↓

2025 Housing Market Recap: A Year of Stabilization

According to the National Association of Realtors, 2025 marked a shift away from volatility and toward stabilization in the U.S. housing market.

Key National and Regional Trends

-

Inventory improved compared to prior years, giving buyers more choices.

-

Affordability remained the biggest challenge, largely due to elevated mortgage rates.

-

Home prices leveled off, with modest variation by region.

-

Buyer activity stayed cautious, with cash buyers and repeat buyers dominating.

-

First-time buyers continued to face barriers, particularly in higher-cost markets.

New Jersey and the Northeast

The Northeast—including New Jersey—proved more resilient than many other regions. Limited housing supply and steady demand helped support prices, even as transaction volume remained measured. Rather than rapid appreciation, 2025 was defined by rebalancing and normalization, laying the groundwork for potential momentum as borrowing conditions ease.

2026 Housing Market Forecasts: What the Experts Are Saying

Looking ahead, several major housing platforms and organizations have released projections for 2026. While forecasts vary, the overall theme is increased stability and opportunity.

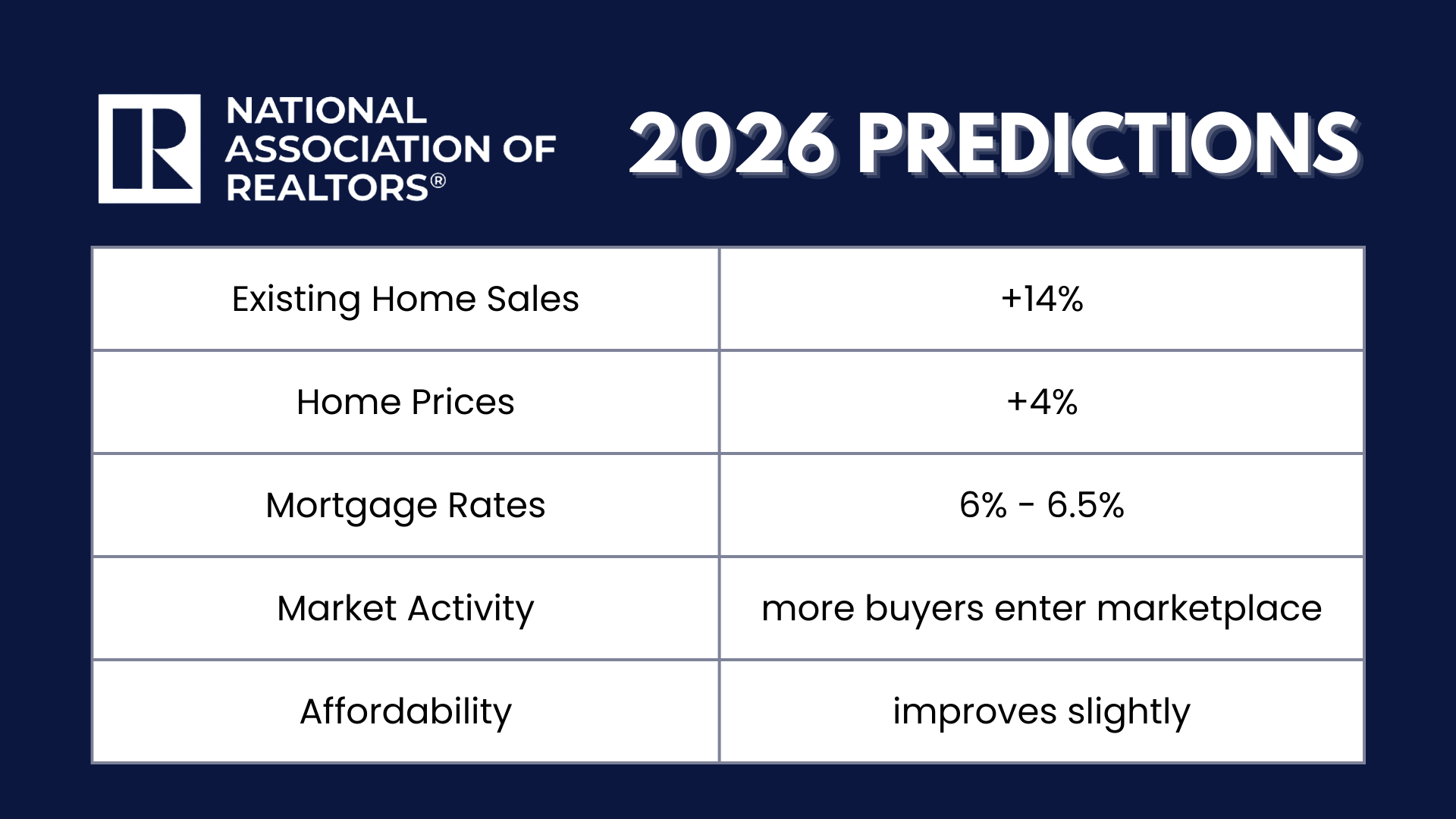

National Association of Realtors (NAR)

-

Existing home sales: Expected to rebound by approximately 14%

-

Home prices: Projected to rise around 4%, similar to 2025

-

Mortgage rates: Forecast to stabilize near the 6% range

NAR attributes these gains to improving affordability and more buyers re-entering the market as rate volatility cools.

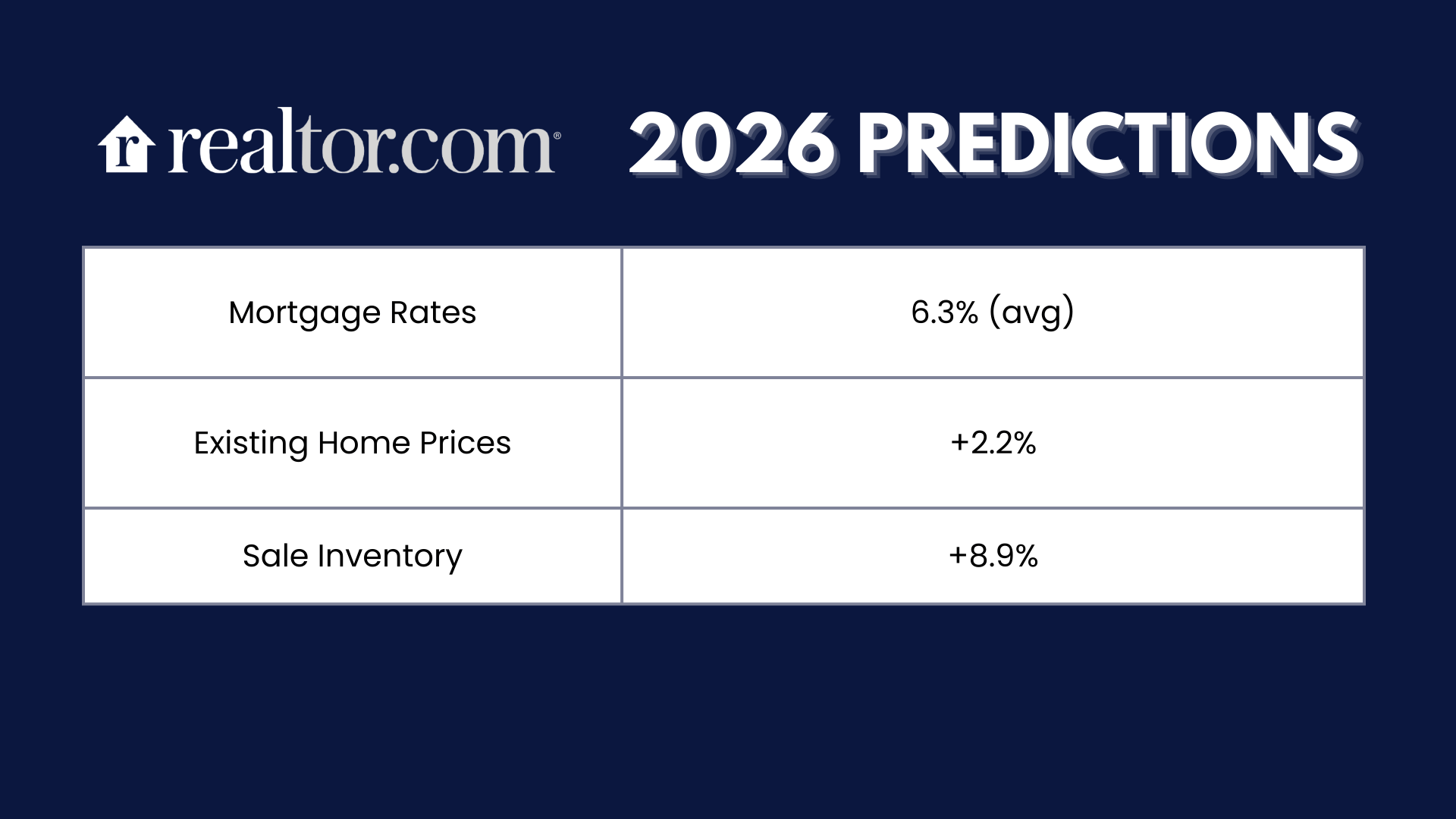

Realtor.com

-

Average mortgage rates: Around 6.3%

-

Home price growth: More modest, approximately 2.2%

-

Inventory: Expected to rise steadily, offering buyers more selection

This outlook points to a more balanced market than 2025, with fewer extremes on either side.

Zillow

-

Home price growth: About 1.2% nationally

-

Existing home sales: Up roughly 4.3% in 2026

Zillow’s forecast suggests cautious optimism, with gradual improvement rather than a sharp rebound.

What This Means for New Jersey Buyers and Sellers

Steady Price Growth, Not Surges

For New Jersey overall, prices are expected to continue rising—but without the double-digit increases seen in earlier years. Sellers may still benefit from appreciation, while buyers can approach the market with less pressure and fewer bidding wars.

Mortgage Rates and Monthly Payments

With mortgage rates potentially stabilizing around 6%, monthly payments may become more predictable. For many buyers—particularly those downsizing into 55+ communities—this can make budgeting easier and planning more realistic when factoring in:

-

Property taxes

-

Insurance

-

HOA fees (where applicable)

-

Mortgage payments

Understanding the full monthly cost, rather than just the purchase price, remains a critical first step.

More Inventory, More Choice

As inventory continues to grow, buyers are seeing more options than in previous years. This is especially relevant for active adult buyers who often prioritize layout, amenities, and community features over speed. A wider selection allows for more deliberate decision-making.

Why This Matters for 55+ Buyers in New Jersey

For residents considering a move into a New Jersey 55+ or active adult community, 2026 may represent a period of opportunity:

-

Greater inventory means more communities and home styles to choose from

-

Slower price growth reduces urgency-driven decisions

-

Stabilizing rates improve long-term planning confidence

Rather than a market driven by fear of missing out, the coming year appears more aligned with thoughtful transitions and lifestyle-based choices.

Final Thoughts: A Year of Normalization and Opportunity

In summary, 2026 is shaping up to be a year of normalization for New Jersey real estate. Buyers may benefit from improved affordability and inventory, while sellers can still expect gradual appreciation without extreme volatility. As always, market conditions remain fluid, and local nuances matter—especially within specific counties and 55+ communities.

Wondering how the 2026 housing outlook might affect your plans this year?

Learn more on our About Us page, then schedule a call to get personalized help finding the right 55+ community.

Categories

Recent Posts